The end of the year calls for big demands — and the shopping surge around Black Friday and Cyber Monday is one of the biggest for any e-commerce or retail business. As a third-party logistics provider (3PL) based in China, SendFromChina works every year with brands globally to handle this complexity. In 2025, the pressure is even greater: consumers start earlier, expect faster shipping, mobile usage dominates, and returns spike. In this guide we’ll walk you through a robust order-fulfillment checklist — tailored for the BFCM (Black Friday/Cyber Monday) peak, with an eye toward global shipping, China sourcing, international warehouses, and logistics realities.

This isn’t just a “to-do list” but a structured approach you can use to audit your readiness, execute with confidence and recover smoothly. The better you prepare now, the fewer fires you’ll face when orders flood in.

1. Why this year demands extra fulfillment readiness

As we head into the 2025 peak season, the stakes are higher than ever for fulfilment teams. A few data-points underline why this year demands extra readiness:

According to Adobe, online holiday season spend (Nov 1–Dec 31) is forecast at US $253.4 billion, up ~5.3% year-on-year.

Mobile devices will account for over 56% of online revenue this season.

Order volumes for peak days like Black Friday are expected to grow by nearly 18.6% in 2025.

A recent trend report by Connexity highlights that the holiday shopping season is starting earlier and lasting longer—so the “peak period” isn’t just a few days anymore.

Logistics complexity is rising: more cross-border flows, more pressure on carriers, high expectations for delivery speed and accuracy.

For brands relying on China-sourced goods with global fulfilment, this means: you cannot assume your usual “peak” process will work. Inventory lead-times, shipping slots,

customs clearances,

last-mile delivery—all must be reviewed and stress-tested. A single mis-step in fulfilment can lead to customer disappointment, negative reviews, and worse: lost lifetime value.

Therefore, this 2025 checklist is designed to help you prepare early, execute intensely, recover smartly—and turn this high-stakes period into a competitive advantage.

2. Pre-Peak Planning (3-4 months ahead)

Ideally at least 90–120 days (or more) ahead of the main BFCM surge, you’ll want to activate your planning cycle. Here are the critical elements:

Demand forecasting & inventory planning

Use historical BFCM data plus trend adjustments (e.g., 18.6% growth prediction in 2025) to size your order volumes.

Segment SKUs by “high velocity / high risk”, “steady seller”, “long-tail” and allocate buffer accordingly.

For China-sourced brands: factor in longer lead times, possible port congestion, customs clearance delays.

Ensure you have inventory staging in key fulfilment hubs ahead of time — inbound to warehouses or cross-dock centres—and avoid last-minute shipments.

Supplier & manufacturing coordination

Confirm your sourcing pipeline: raw materials, production schedule, quality assurance, packaging,

kitting.

For goods produced in China: factor in domestic transport to port, export documentation, and global freight booking. If shipping to US/EU/other markets, consider early arrival into destination warehouses or hubs.

Communicate promotional timelines clearly to suppliers so they know when surge volumes will hit.

Fulfilment capacity planning

Audit your fulfilment network: warehousing capacity, labour availability, equipment (e.g., conveyors, sorters, packing stations).

For 3PLs and logistics providers: establish peak contracts, ramp-up labour, schedule overtime/shifts where needed.

Confirm with carriers: shipping cut‐off dates, blackout periods, last-mile capacity. For example, peak season delivery frameworks show “Black Friday falls on 28 Nov 2025, Cyber Monday on 1 Dec” in many markets.

Get fallback options: multiple carriers, alternate routes, contingency plans for delays or disruptions.

Technology & systems readiness

Inventory syncing: oversells and

stockouts are common during BFCM.

Prepare real-time dashboards and alerts: low stock, delayed shipments, exceptions.

System load testing: your website and back-end should handle traffic surges.

Packaging & value-adds

Standardise pack materials and ensure you have plenty of supplies: outer boxes, tape, labels, filler, gift-wrap if applicable.

If you’re including promotional kits, bundles, gift-with-purchase, plan their fulfilment flows now.

For China origin shipments: ensure packaging meets destination market regulations (e.g., EU packaging compliance, US safety standards, labelling).

Plan for returns packaging too—peak weeks drive return volumes.

Shipping strategy & transit plan

Define shipping windows & delivery promises: e.g., “ship within 24 h”, “2–4 day transit”, etc.

For cross-border flows: send to regional hubs ahead of time to avoid congestion.

Determine cut-off dates in each region: carriers often publish shipping cut-offs before Black Friday/Christmas.

Consider “early dispatch” deals to spread load and avoid all shipments hitting carriers at once.

Risk management & contingency

Map out risk scenarios: port disruption (especially China-to-US/EU), carrier capacity shortage, labour shortage, customs delay, high return rates.

Assign roles/responsibilities, escalation protocols.

Build spare capacity: extra warehouse space, buffer stock at alternate location, alternate carrier contracts.

Ensure clear customer communications policy in case of delays.

Stakeholder alignment & service level agreements (SLAs)

Align with marketing, sales, customer-service, logistics teams: they need to operate in sync.

Set internal SLAs: e.g., “orders placed by 3 pm ship same day”, “customer support responses within 1 h during peak”.

For your logistics provider talking to brands: make sure you’re onboarded early, understand their promotional calendar, SKU mix, destination geographies and service expectations.

Evaluate performance metrics from past peaks and set improvement targets.

By the end of this pre-peak phase, your fulfilment engine should be primed, rehearsed, and equipped to handle the surge.

3. Peak-Week Execution (the week of BFCM)

When the surge hits – typically the days surrounding Black Friday (28 Nov 2025) and Cyber Monday (1 Dec 2025) – operational discipline is crucial.

Order volume spike awareness

Expect substantially higher order volumes. Data suggests this year could see ~18.6% growth in volume.

Weekend and Monday peaks: for many markets, Cyber Monday dispatches may exceed Black Friday.

Real-time monitoring: track order intake, warehouse outbound throughput, carrier pickups and transit times.

Picking, packing and dispatch operations

Use batch processing, zone picking, wave operations to speed up fulfilment. The Sellbrite team suggests having a “clear process prevents mistakes and speeds up fulfilment when you’re handling 3–5x your normal order volume.”

Maintain quality and accuracy: a single mis-ship or wrong

SKU can cause outsized customer dissatisfaction.

Keep spare labour on stand-by: peak shifts, weekend/late hours may be required.

Use dedicated packing stations for high-volume SKUs, promotional bundles, gift/kit orders.

Ensure dispatch to carriers is timely: monitor cut-off times, arrange for last-minute carrier pickups if needed.

Carrier & shipping coordination

Confirm pickup windows each day; if a carrier misses its window, shipments may roll over, causing delay.

Monitor shipping zones: some regions may experience overloads.

For cross-border shipments (China origin): track container, customs clearance, inland transport and final dispatch to destinations.

Communicate proactively with carriers about volume surges and any expected bottlenecks.

Customer communication & fulfilment transparency

Let customers know expected ship-out time and delivery window. Transparency builds trust. The ConnectPOS team emphasises that “Checkout and fulfilment are critical… A smooth process keeps shoppers engaged and reduces abandoned carts.”

Send automatic confirmations: order received, order packed, order dispatched, tracking available.

Prepare your customer-service team for higher volume of queries (WISMO – “Where Is My Order?”).

For any delays or disruptions: proactively inform customers, offer real-time updates or compensation where appropriate.

Inventory & returns handling

Monitor real-time

inventory levels: high-velocity SKUs may deplete quickly—trigger buffers, re-allocate stock between fulfilment hubs quickly if needed.

Manage returns flow: returns typically spike after peak week. Pre-establish return routing, processing capacity and reverse logistics.

Analyse live fulfilment data: pick-errors, mis-packs, transit delays, carrier exceptions. Quick corrective actions as needed.

Post-order fulfilment and last-mile considerations

Focus on delivery-in-promised-time: higher than normal. Customers expect fast shipping during BFCM.

For global shipments: monitor customs clearance, duties/taxes, local courier handovers.

Have escalation procedures if delivery performance degrades (e.g., alternate last-mile carrier, express upgrade).

Evaluate carrier performance daily: delays, exceptions, failed first-attempt deliveries—all must be logged and mitigated.

Sustainability & cost-control pointers

The logistics industry is increasingly conscious of sustainability. For example, one report showed delivery emissions for Black Friday 2025 are projected to exceed millions of tonnes of CO₂ unless optimised routing is applied.

Keep cost control in mind: surge volumes may lead to extra carrier charges, fuel surcharges, overtime labour – ensure these are managed.

Post-peak, you’ll want to evaluate cost per order, cost per delivery, and compare against target.

4. Post-Peak Recovery & Analysis (Immediately after peak weeks)

Once the surge is over, it’s tempting to “take a breather” — but the phase of recovery and analysis is just as important.

Immediate checklist

Reconcile pending orders: ensure all orders placed during peak period have been picked, packed, dispatched or cancelled/refunded as appropriate.

Process returns promptly: allocate resources to the returns-processing backlog so customers experience good service even after the peak.

Conduct a “post-mortem” of surge operations: what went well, what bottlenecks popped up, what needs improvement.

Data review & KPI measurement

Compare actual vs forecast volumes, shipments, average dispatch time, carrier transit time, cost per order, fulfilment accuracy.

Track operational KPIs:

picking accuracy, packing accuracy, shipping cut-off adherence, first-attempt delivery success, customer support response times.

Analyse customer feedback: post-order NPS, complaints, mis-ships, late deliveries. These influence brand loyalty far beyond one season.

Cost and profitability review

Review incremental costs incurred: extra labour, overtime, shipping surcharges, inbound freight from China, packaging, returns processing.

Assess average order value (AOV), return rate, cancellations, and incremental revenue generated.

Inventory rebalancing & de-stocking

Re-assess safety stock levels: some items may now be overstocked, others understocked for next season.

Consider clearance strategies for slow-moving SKUs that remained unsold during peak.

Move excess regional inventory to cheaper hubs or convert to promotional items for Q1.

Continuous improvement & process update

Document lessons-learned and update your fulfilment playbook (for example with SendFromChina you may integrate China-sourcing façade more tightly).

Conduct a post-peak “stress test” of your network: identify which fulfilment hubs or carriers struggled and update contracts/resourcing as needed.

Align with sourcing teams: review how inbound logistics (China → global hubs) performed — were there delays, customs issues, port congestion?

Update your vendor and carrier scorecards, build improvement plans for next peak.

5. Specialized Considerations for China-based Sourcing & Global Fulfilment

Since

SendFromChina operates as a China-based

third-party logistics partner specialising in sourcing and global fulfilment, this section focuses on what brands in your position must pay extra attention to.

Lead-time & freight booking from China

Chinese manufacturing often implies tight lead-times— for peak volumes you must secure production slots early, especially for Black Friday/Cyber Monday goods.

Freight booking: ensure containers or air freight from China to destination countries are booked well in advance. With global freight networks under stress, last-minute bookings may incur high surcharges or delays.

Port and inland transport risk on China export side: Even small disruptions (labour dispute, customs inspection, regulatory hold) can ripple into fulfilment. Plan buffer days.

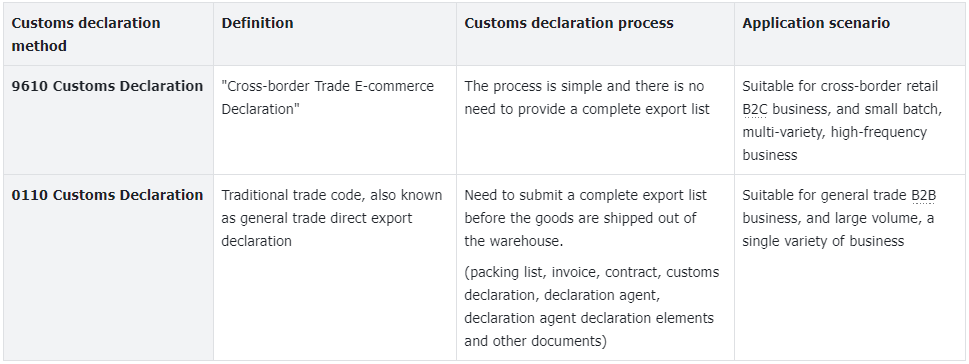

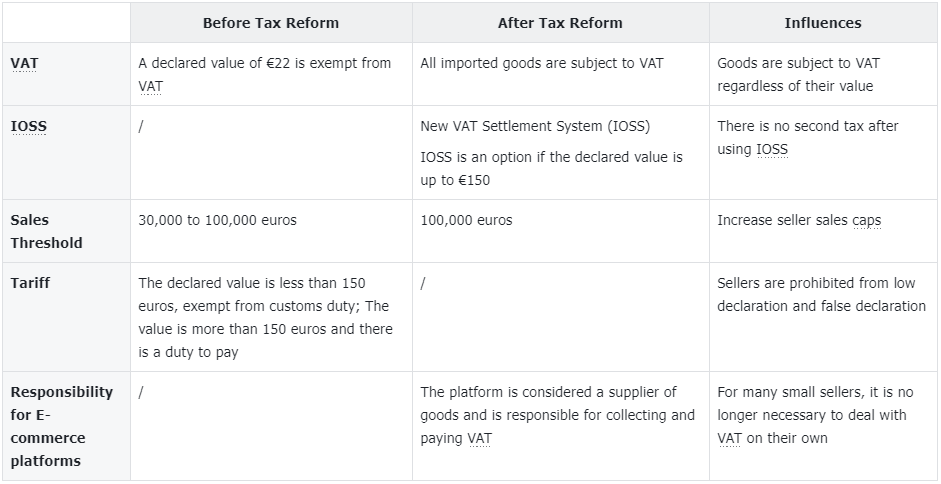

Customs, duties & compliance

For cross-border shipments from China, ensure documentation (export, import) is pre-approved.

Be aware of destination-country regulations: labelling, safety standards, packaging, tariffs. Any non-compliance can cause shipments to be held.

Regional hubs & fulfilment distribution

Depending on geography, you may ship China→regional hub (e.g., US, EU, Asia) ahead of demand, then fulfil last-mile locally.

For peak period, using a network of hubs reduces overseas transit risk and shortens delivery times.

Manage stock-splitting: pre-allocate inventory across hubs based on regional demand forecasts – over-stocking one region and under-stocking another is a common mistake.

China-origin packages & local last-mile partnerships

Domestic Chinese e-commerce and exports are efficient but you still need to ensure smooth hand-off to local couriers at destination. Last-mile partner reliability matters heavily.

Monitor tracking integration: many global customers expect full tracking visibility—even for goods sourced in China.

Returns from destination back to China: For certain items, you may need to decide whether returns will be local (destination country) or sent back to China hub. The reverse logistics cost must be modelled.

Communication and visibility

Ensure transparency with brands and customers: if you are sourcing in China and shipping globally, set expectations for lead-time, customs, delivery windows.

Real-time dashboards: The larger the global footprint, the more complex the tracking. Make sure you have visibility across origin (China), transit, hub, last-mile.

Flexibility: With global markets, you may encounter regional disruptions (weather, labour strikes, geopolitical issues) that impact China-origin flows—having alternate sourcing or routing options is an advantage.

Because SendFromChina specialises in China-origin logistics combined with global fulfilment, you can use your unique position as a strength: highlight strong sourcing reliability, cross‐border expertise, and peak-season readiness as a differentiator for your clients.

6. 2025 BFCM Unique Highlights for Fulfilment Teams

The 2025 season carries several unique features you must incorporate into your planning:

Extended promotional window: The period is no longer just Black Friday + Cyber Monday. As Connexity notes: “The holiday season is starting earlier and lasting longer”.

Mobile-first shopping: With mobile now expected to represent ~56% of online revenue. Fulfilment expectations also shift: rapid shipping, mobile notifications, tracking updates.

Increased ‘Buy Now, Pay Later’ (BNPL) and alternative payment methods: These payment options drive higher AOVs but also higher risk of returns or cancellations—so your fulfilment operation must be responsive.

AI-driven shopping behaviours and inventory demands: Traffic influenced by AI chatbots, personalised offers, dynamic pricing. These trends accelerate impulsive order spikes, so fulfilment systems must be highly agile.

Global supply-chain pressures: For China-sourced goods, global freight and port capacity remain under pressure. One white paper anticipated container/equipment shortages because of China export surges.

Sustainability and consumer expectations: The blog from SmartRoutes highlights how delivery emissions are becoming a reputational issue.

Carrier and network risk: With surge volumes, carrier networks may impose surcharges or experience failures. A recent forecast by ShipMatrix predicted US parcel volumes up ~5% for the 2025 season — so carriers will be under strain.

7. The 25-Step Checklist at a Glance

Here’s a condensed checklist you can print or share with your team:

Set clear BFCM goals & KPIs (order volume, AOV, delivery time)

Forecast demand (use last-year + growth factor)

Segment SKUs by velocity, risk and margin

Confirm manufacturing lead-times & freight bookings from China

Secure inbound freight & container slots early

Audit fulfilment network capacity (warehouse, labour, equipment)

Ensure multi-carrier contracts and fallback routing

Load-test technology (OMS/WMS, website, inventory sync)

Ensure real-time inventory visibility & avoid oversells

Standardise packaging and ensure sufficient stock of supplies

Plan promotion fulfilment flows (bundles, gift-with-purchase)

Define shipping promises and cut-off dates per region

Align cross-functional teams: sourcing, logistics, customer-service, marketing

Document risk map and contingency plans (port delay, customs, carrier failure)

In surge week: batch process picking/packing, dedicate high-volume SKU flows

Monitor carrier pickups and transit times daily

Keep customers informed: order confirmation, dispatch, tracking

Manage returns proactively: routing, capacity, policy

Track KPIs in real-time: pick accuracy, dispatch speed, delivery success

Post-peak: reconcile pending orders, process returns backlog

Conduct post-mortem: lessons learnt, bottlenecks identified

Analyse cost per order, incremental cost, ROI of promotions

Re-balance inventory: move excess stock, clear slow-moving SKUs

Update fulfilment playbook: reflect what worked / didn’t

For China-sourced global fulfilment: evaluate inbound channel performance, customs clearance, hub distribution, last-mile reliability

8. Conclusion

The 2025 Black Friday and Cyber Monday period will test fulfilment operations like never before. With higher volumes, mobile-first shoppers, extended promotional windows, global sourcing from China and elevated customer expectations, fulfilment efficiency is the differentiator. For brands that get their fulfilment act together—sourcing, warehousing, shipping, customer communication—the rewards will be substantial. For those who rely on legacy processes, the risk of breakage is real.

9. FAQs

Q1: When should we start preparing for Black Friday and Cyber Monday?

A1: Ideally at least 3–4 months ahead (i.e., now if you’re reading this). Many brands begin planning production, inbound freight and fulfilment network setup in Q3 for a late-November BFCM.

Q2: How much increase in order volume should we expect this year?

A2: Forecasts for 2025 indicate order volume growth of around

18.6% compared with the previous year. That said, your specific growth will depend on your promotion size, region, product category and supply-chain constraints.

Q3: What unique risks apply when sourcing from China for BFCM?

A3: Key risks include: longer freight lead times, port or export delays in China, customs clearance at destination, container/equipment shortages, capacity bottlenecks at hubs. Forward planning and buffer stock in regional hubs help mitigate these.

Q4: What are the biggest fulfilment mistakes to avoid during peak week?

A4: Common mistakes: overselling due to out-of-sync inventory; packing/picking errors due to rush and lack of process; shipping cut-offs missed because carriers overloaded; poor customer communication when delays occur. Each of these can erode brand trust.

Q5: How should we handle returns and post-peak recovery?

A5: Immediately after peak week you should recognise returns will spike. Allocate capacity for returns processing, reconcile all pending orders, evaluate cost and operational data, harvest lessons-learned, rebalance inventory and update your fulfilment playbook.

Post Views:2568

Post Views:2568

Want to know about our services, fees or receive a custom quote?

Want to know about our services, fees or receive a custom quote? Please fill out the form on the right and we will get back to you within a business day.

Please fill out the form on the right and we will get back to you within a business day.

The more information you provide, the better our initial response

will be.

The more information you provide, the better our initial response

will be.

TAGS:

TAGS: