Table of Contents

3PL Performance Metrics: Key KPIs for 3PLs

Time: Sep 01,2025 Author: SFC Source: www.sendfromchina.com

In today's competitive supply chain landscape, choosing the right third-party logistics (3PL) provider goes beyond smooth deliveries and warehouses. The real differentiator lies in measurable performance—how precision, speed, and cost efficiency translate into everyday results.

1. What Is 3PLs

Third-party logistics, or 3PL, refers to outsourcing logistics functions—like warehousing, transportation, and fulfillment—to specialized providers. They manage aspects of your supply chain so you can focus on your core business. 3PLs range from simple warehousing and delivery services to highly integrated partners offering customized operations, technology, and value-added services.3PL providers are vital to scaling operations efficiently, especially in fast-moving markets—like e-commerce—where flexibility, geographic reach, and expertise make all the difference.

2. Inventory Management Performance Metrics

Inventory management isn’t just about having stock—it’s about controlling, forecasting, and delivering accuracy at every step. Below are essential KPIs every 3PL should meticulously track, interpret, and improve upon:

Inventory Accuracy Rate

Measures how precisely the warehouse management system (WMS) reflects actual stock levels.Why it matters: High accuracy prevents stockouts, overstock, fulfillment errors, and mis-shipped products.

Benchmark: Aim for >99.5% for best-in-class performance; many operations struggle at 65–75% without robust systems.

How to improve:

Regular cycle counts (2–4 times/year) plus annual full physical audits.

Use barcode or RFID systems and automate entry to reduce human error.

Implement real-time monitoring and WMS integration to sync counts and updates instantly.

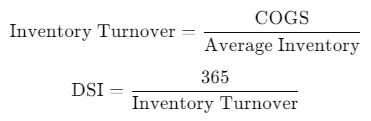

Inventory Turnover Ratio & Days Sales of Inventory (DSI)

Reflects how often inventory is sold and replenished.Formula:

Why it matters:

A high turnover means healthy demand and reduced holding costs.

A low turnover signals overstock, obsolescence risk, and excessive capital tied up.

DSI gives perspective on how long stock lingers—lower is better for cash flow and responsiveness.

Inventory Shrinkage

Quantifies inventory loss due to damage, theft, or errors.Sources of shrink: Manufacturer discrepancy, in-transit damage, handling errors in warehouses.

Why it matters: Impacts cost accounting, availability, and erodes trust.

Industry note: Some 3PLs allow ~0.5% shrinkage, but elite providers push for zero tolerance—and even compensate for any lost goods.

Reorder Point & Safety Stock

Indicates when it’s time to reorder to avoid stockouts.Formula:

Why it matters: Helps maintain supply continuity and balances holding costs with availability.

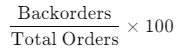

Backorder Rate & Stockout Rate

The Stockout Rate measures the percentage of time a specific SKU (Stock Keeping Unit) is completely unavailable for purchase, meaning it has zero physical inventory in the warehouse and is also not available for backordering. The Backorder Rate measures the percentage of customer orders for a specific SKU that could not be fulfilled immediately because the inventory was unavailable at the time the order was placed.Backorder Rate:

Stockout Rate:

Why it matters: High rates damage customer trust and directly erode revenue and retention.

Inventory Carrying Cost

The total expense of holding inventory—including storage, insurance, depreciation, and labor.Why it matters: Holding excess stock drains profitability; tracking carrying cost reveals where efficiencies—or reductions—can improve margins.

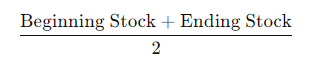

Average Stock & Optimal Stock Level

Helps manage volume sitting in warehouses—neither too much nor too little.Average Stock:

Optimal Stock Level: Includes best mix of reorder quantities, minimum stock, and safety stock—maximizing profitability and minimizing holding costs.

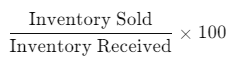

Sales-Through Rate (STR)

Monitors inventory velocity relative to receipts.Formula:

Why it matters: Reveals how quickly inventory moves; a key indicator in ecommerce where margins are tight.

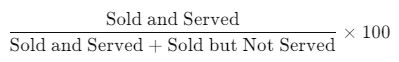

Cycle Service Level

Percent of demand met without stockouts during inventory cycle.Formula:

Why it matters: Helps ensure stock availability in alignment with demand forecasts.

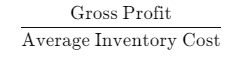

Gross Margin Return on Inventory Investment (GMROI)

Reflects profitability per inventory dollar held.Formula:

Why it matters: Balances margin, turnover, and inventory investment—critical to evaluating SKU-level performance and broader inventory health.

3. Customer Satisfaction Performance Metrics

In logistics, especially within 3PL services, customer satisfaction is more than a nice-to-have—it's a keystone of reputation, retention, and revenue. Here are critical KPIs that shine a light on how well your 3PL partner is meeting expectations—and how SendFromChina sets the bar.

Shipping Accuracy Rate

Assesses how often packages are delivered without errors in content or address.Why it matters: Mistakes frustrate customers and raise costs through returns and re-shipping.

Ideal rate: Above 99% is considered standard, with elite 3PLs pushing higher.

Perfect Order Rate

Represents the percentage of orders that are delivered on time, complete, undamaged, and with correct documentation.Why it matters: This all-encompassing metric ties together accuracy, timing, condition, and paperwork—key for elevating the customer experience.

Return Processing Time & Return Rate

Tracks how long returns take to process and the frequency of returns due to logistics errors.Why it matters: Swift returns build customer confidence; tracking the rate of returns identifies fulfillment weaknesses.

Benchmarks: Best-in-class 3PLs process returns within 24 hours, though 48–72 hours is more common.

Delivery Accuracy & First-Time Delivery Success

Captures whether orders arrive correctly on the first attempt—without damage, delays, or reattempts.Why it matters: Privacy around delivery attempts, damage, and completeness are deeply tied to customer trust and satisfaction metrics.

Benchmark: Aim for 95%+ successful first-time deliveries.

Customer Satisfaction Score (CSAT)

A direct measure of customer sentiment post-delivery or interaction.Why it matters: CSAT reveals subjective perceptions—immediately reflecting experience quality.

Target: CSAT scores above 80–90% are considered strong in logistics contexts.

Net Promoter Score (NPS) & Willingness to Recommend

Assesses customers’ likelihood to recommend your service—an indicator of loyalty and advocacy.

Why it matters: High NPS signals customer delight—and translates into repeat business and referrals.

Willingness to recommend, as a concept, connects directly to long-term retention.

Customer Complaints & Resolution Efficiency

Monitors complaint volume and how quickly and effectively they are resolved.Why it matters: Reducing complaint response time and volume strengthens relationships and discourages churn.

Best practices: Acknowledge complaints quickly, communicate clearly during resolution, and maintain transparency.

4. Order Fulfillment Performance Metrics

Order fulfillment is where supply chain precision translates directly into customer trust. These metrics shed light on how effectively a 3PL converts incoming orders into timely, accurate deliveries. Here’s how to evaluate them—and how SendFromChina builds excellence in this domain:

Order Accuracy Rate

What it measures: Percentage of orders shipped without any picking or packing errors—right items, right quantities, correct address.Why it's vital: Mistakes at this stage drive up customer dissatisfaction, returns, and waste—avg. pick errors can cost ~$42 each.

Benchmark: Good 3PLs target 96–98%; top-tier providers exceed 99.9% accuracy.

Improvement strategies: Use barcode scanning, automated systems, and quality checkpoints.

On-Time Shipping Rate

What it measures: Percentage of orders shipped on or before the 3PL's committed cutoff time.Why it matters: A late dispatch erodes delivery promises, even if carriers meet transit goals—55% of customers may stop buying after multiple late deliveries.

Benchmark: Industry standard surpasses 97% on-time; world-class exceed 99%.

Order Fulfillment Cycle Time

What it measures: Time from when an order is placed to when it's shipped. More comprehensive versions include shipping to the customer.Why it's important: Shorter cycle times improve responsiveness and reduce friction.

Typical figures: Top retailers average ~1.8 days; many deliver within one week.

Optimization tips: Break down cycle time into picking, packing, shipping stages for better diagnostics.

Order Picking Accuracy

What it measures: Precision of the picking process—percent of picks completed with zero mistakes.Why it matters: Picking errors are a leading cause of customer frustration and returns—up to 23% of returns stem from wrong items picked.

Best practices: Barcode systems, pick-to-light, frequent audits, and picker training dramatically reduce errors.

Order Fill Rate (or Fill Rate)

What it measures: Percentage of customer orders fulfilled completely from available inventory at first shipment.Why it's vital: Incomplete orders mean backorders, extra shipments, and diminished customer trust.

Target: Maintain fill rates above 95% to ensure reliability.

Cost Per Order / Cost Per Unit Shipped

What it measures: Total fulfillment cost divided by number of orders or units—includes labor, packaging, shipping, and storage.Why important: Directly impacts profit margins; a decreasing trend signals growing efficiency.

Why track it: Helps isolate inefficiencies and scale improvements.

Shipping Cost Per Order

What it measures: Portion of the per-order cost attributed specifically to carrier fees and shipping expenses.Why it matters: Allows negotiation strategies, carrier optimization, and packaging improvements.

Typical improvements: Carrier selection, dimensional weight reduction, and route planning help cut costs.

5. Operational Efficiency Performance Metrics

Operational efficiency is the backbone of a high-performing 3PL—where every movement, every square foot, and every minute counts. These metrics shine a light on how well resources are used, productivity is driven, and costs are managed. Here’s what matters most:

Warehouse Capacity Utilization

What it measures: The percentage of available warehouse space being actively used.Why it matters: Underutilized space wastes money; overutilization strains operations. Targeting around 85–90% utilization balances space efficiency with flexibility.

Best practices: Use vertical storage, dynamic slotting, and WMS-led layout optimization to maximize space while retaining operational flow.

Cycle Time (Processing/Order Cycle Time)

What it measures: Time taken for a task or order from start to completion—including processing, picking, and shipping.Why it matters: Shorter cycle times improve throughput and responsiveness. They’re fundamental to customer satisfaction and internal agility.

Improvement Tactics: Break processes into stages and tackle individually; apply lean methods to reduce delays.

Overall Labor Effectiveness (OLE)

What it measures: Combines employee availability, performance, and quality into one productivity metric.Why it matters: Pinpoints how labor is truly contributing. It fuels lean improvements and identifies bottlenecks in staffing or training.

Strategies: Monitor scheduled vs. productive time; assess output against standards; track quality yield to drive better workforce execution.

Delivery Schedule Adherence (DSA)

What it measures: The percentage of deliveries that meet the scheduled delivery time.Why it matters: Low adherence leads to inflated buffer stocks, increased costs, and poor service reliability.

Optimization: Use predictive scheduling and visibility tools to align to-the-minute delivery performance.

Operating Ratio (Cost Efficiency)

What it measures: Operating expenses (including costs of goods sold) as a percentage of net sales.Why it matters: A lower ratio signals stronger cost control and profitability—vital in tight-margin logistics.

Tactics: Benchmark over time, dissect major cost drivers, and track impacts of efficiency improvements.

Employee Productivity & Throughput

What it measures: Output per employee, such as orders or lines picked per hour.Why it matters: Directly tied to operational capacity, staffing costs, and scalability.

Boosting Tactics: Training, process simplification, cross-training, and shift-level staffing alignment.

Damage Rate

What it measures: Percentage of goods damaged during handling or transit.- Why it matters: Damaged items drive unexpected costs, replacements, and reduced trust.

- Prevention: Implement proper packaging, train staff in careful handling, and ensure maintenance of transport assets.

6. Financial Performance Metrics

Financial performance metrics are crucial for assessing the economic health and profitability of a 3PL provider. These indicators not only reflect operational efficiency but also influence strategic decisions and client partnerships. Below are key financial metrics every logistics provider should monitor:

Revenue Growth

What it measures: The percentage increase in revenue over a specific period.Why it matters: Consistent revenue growth indicates a company's ability to expand its market share, attract new clients, and enhance service offerings. For instance, Kuehne + Nagel reported a 19% increase in turnover to 6.76 billion francs in Q4 2024, signaling strong market demand and effective sales strategies.

Improvement Tactics:

Diversify service offerings to cater to a broader client base.

Expand into new geographic markets.

Enhance customer retention through improved service quality.

Operating Profit Margin

What it measures: Operating profit as a percentage of revenue.Why it matters: A higher operating profit margin indicates efficient cost management and the ability to generate profit from core operations. For example, C.H. Robinson Worldwide's adjusted EPS for Q2 2024 was $1.15, a 25% increase from the previous year, reflecting improved cost controls.

Improvement Tactics:

Optimize operational processes to reduce waste and inefficiencies.

Negotiate better terms with suppliers and partners.

Invest in technology to automate and streamline operations.

Return on Investment (ROI)

What it measures: The return generated on investments made, expressed as a percentage.Why it matters: A high ROI indicates that investments are yielding profitable returns, which is essential for sustaining growth and attracting further investment. In the logistics industry, ROI can be influenced by factors such as fleet expansion, technology upgrades, and infrastructure development.

Improvement Tactics:

Conduct thorough market research before making investments.

Monitor and evaluate the performance of investments regularly.

Adjust strategies based on performance data to maximize returns.

Cash Flow

What it measures: The net amount of cash being transferred into and out of the business.Why it matters: Positive cash flow ensures that a company can meet its financial obligations, invest in growth opportunities, and navigate economic downturns. In logistics, managing cash flow is critical due to the high capital expenditures associated with fleet maintenance and infrastructure investments.

Improvement Tactics:

Streamline invoicing and collections processes to accelerate receivables.

Negotiate favorable payment terms with clients and suppliers.

Maintain a cash reserve to handle unexpected expenses.

Debt-to-Equity Ratio

What it measures: The proportion of company financing that comes from debt and shareholders' equity.Why it matters: A balanced debt-to-equity ratio indicates a company's ability to leverage debt for growth without overextending itself financially. An excessively high ratio may signal financial risk, while a very low ratio could suggest underutilization of growth opportunities.

Improvement Tactics:

Maintain a conservative approach to borrowing.

Focus on increasing equity through retained earnings and new investments.

Regularly review financial strategies to ensure optimal capital structure.

Return on Assets (ROA)

What it measures: Net income generated per unit of assets.Why it matters: A higher ROA indicates efficient use of assets to generate profits. In logistics, this can be influenced by factors such as fleet utilization, warehouse capacity, and technology investments.

Improvement Tactics:

Enhance asset utilization through better scheduling and maintenance.

Invest in technology to improve operational efficiency.

Regularly assess asset performance and make necessary adjustments.

Gross Profit Margin

What it measures: The difference between revenue and the cost of goods sold, expressed as a percentage of revenue.Why it matters: A higher gross profit margin indicates that a company is efficiently producing and selling its services at a profit. In the logistics industry, this can be influenced by factors such as fuel costs, labor expenses, and pricing strategies.

Improvement Tactics:

Negotiate better rates with suppliers and service providers.

Implement cost-saving technologies and practices.

Review and adjust pricing strategies to reflect market conditions.

Days Sales Outstanding (DSO)

What it measures: The average number of days it takes to collect payment after a sale has been made.Why it matters: A lower DSO indicates that a company is efficiently collecting receivables, which improves cash flow and reduces the risk of bad debts. In logistics, managing DSO is essential due to the high volume of transactions and the need for timely payments to maintain operations.

Improvement Tactics:

Implement automated invoicing and reminders.

Offer discounts for early payments to encourage prompt settlement.

Establish clear credit policies and conduct regular credit assessments.

7. Choose 3PLs After Checking 3PLs Mertrics

Selecting the right third-party logistics provider is a pivotal decision that can significantly impact your business's efficiency, customer satisfaction, and bottom line. After assessing key performance metrics—such as inventory accuracy, order fulfillment speed, and financial health—it's essential to delve deeper into the qualitative and strategic aspects of potential 3PL partners. This comprehensive evaluation ensures that your chosen provider aligns with your business goals and can scale with your growth.

Align with Your Business Objectives

Begin by clearly defining your logistics goals. Are you aiming to reduce shipping costs, enhance delivery speed, or improve customer service? Understanding your objectives will help you identify a 3PL provider whose capabilities align with your needs. For instance, if rapid delivery is a priority, partnering with a 3PL that offers expedited shipping services and has a network of strategically located warehouses can be beneficial.Evaluate Technological Capabilities

In today's digital age, technology plays a crucial role in logistics operations. Assess the 3PL's technology infrastructure, including their warehouse management systems (WMS), transportation management systems (TMS), and integration capabilities with your existing platforms. A provider with advanced technology can offer real-time tracking, automated inventory updates, and seamless order processing, leading to improved efficiency and customer satisfaction.Consider Geographic Coverage

The geographic reach of a 3PL provider can influence shipping times and costs. Evaluate whether the provider has a presence in the regions where your customers are located. For example, if you have a significant customer base in Europe, choosing a 3PL with operations in that region can reduce delivery times and shipping expenses. Additionally, consider their ability to handle international shipping if your business operates globally.Assess Customer Service and Communication

Effective communication and responsive customer service are vital in a 3PL partnership. Assess the provider's customer support channels, response times, and willingness to collaborate. A 3PL that offers dedicated account managers, 24/7 support, and proactive problem-solving can help address issues promptly and maintain smooth operations.Review Scalability and Flexibility

As your business grows, your logistics needs may evolve. Ensure that the 3PL provider can scale its operations to accommodate increased order volumes, seasonal fluctuations, and expanding product lines. A flexible provider can adapt to changes in demand and adjust services accordingly, ensuring continuity and efficiency.Analyze Cost Structure and Value Proposition

While cost is an important factor, it should not be the sole consideration. Evaluate the 3PL's pricing structure, including storage fees, handling charges, and transportation costs. Compare these costs with the value provided, such as improved delivery times, enhanced customer satisfaction, and reduced operational complexities. A cost-effective provider offers a balance between affordability and quality service.Examine Service Level Agreements (SLAs)

Service Level Agreements (SLAs) define the expectations and responsibilities of both parties in the partnership. Review the SLAs to ensure they align with your business requirements. Key elements to consider include order accuracy rates, on-time delivery percentages, inventory turnover goals, and penalties for non-compliance. Clear and mutually agreed-upon SLAs can prevent misunderstandings and ensure accountability.Conduct Site Visits and Pilot Programs

Before finalizing the partnership, visit the 3PL's facilities to assess their operations firsthand. Observe their warehouse organization, inventory management practices, and overall efficiency. Additionally, consider initiating a pilot program to test their services with a limited number of orders. This trial run can provide insights into their capabilities and help identify potential issues before full-scale implementation.Seek References and Case Studies

Request references from the 3PL provider's existing clients, particularly those in similar industries. Their experiences can offer valuable insights into the provider's performance, reliability, and customer service. Additionally, review case studies or testimonials to understand how the 3PL has addressed challenges and delivered results for other businesses.Monitor and Review Performance Regularly

Once the partnership is established, continuously monitor the 3PL's performance against the agreed-upon metrics. Regular reviews allow you to identify areas for improvement, address concerns promptly, and ensure that the provider continues to meet your evolving business needs. Establishing a feedback loop fosters a collaborative relationship and drives continuous improvement.8. Find a More Reliable 3PL Partner? Look SendFromChina Now!

If you’re searching for a trusted, data-driven logistics partner based in China, SendFromChina supports brands with a full spectrum of KPIs baked into our operations.- Cutting-edge warehousing technology: We deliver dock-to-stock time under 24h, and our inventory accuracy consistently exceeds 99%.

- Precision order accuracy: We exceed 99.9% order accuracy, minimizing disruptions and support queues.

- Fast fulfillment and returns: Orders are processed and shipped with agility. Return handling is swift—usually same-day.

- Transparent financials: Real-time dashboards show cost per unit, fulfillment costs, and storage expenses—so you stay informed.

- Scale and reliability: Whether you’re scaling across China or globally, we offer flexible solutions, transparent pricing, and consistent performance.

When you partner with SendFromChina, you're choosing a logistics ally focused on metrics—because we understand what's measured can be mastered.

9. Conclusion

3PL performance is only as strong as the KPIs you measure. Inventory accuracy, docking times, order accuracy, fulfillment speed, operational efficiency, and cost metrics all weave together to tell the story of reliability and value. Make smart decisions by benchmarking your 3PLs, demanding transparency, and choosing partners—like SendFromChina—who turn data into action. Performance isn't just delivered—it's proven.10. FAQs

Q1: What KPI matters most in 3PL?

It depends—accuracy and on-time fulfillment often lead, but your business may prioritize cost or inventory turnover.Q2: What is a good order accuracy rate?

Aim for 99.9%. That’s considered industry-leading and helps minimize returns and complaints.Q3: How fast should returns be processed?

Best practices target under 24 hours, with many 3PLs aiming within 48 hours.Q4: Why track cost per unit shipped?

It reveals operational efficiency and highlights savings through scale or optimized logistics.Q5: How do I choose a reliable 3PL?

Start by defining your logistics goals, request KPI data, benchmark against industry standards, and pick a partner—like SendFromChina—that shares performance openly. Post Views:2379

Post Views:2379

Copyright statement: The copyright of this article belongs to the original author. Please indicate the source for reprinting.

Previous Post

Temperature-Controlled Warehousing: What It Is & Why It Matters for E-commerce

Next Post

What Is Order Promising? A Comprehensive Guide for Logistics Leaders

TAGS

Hot Research

Get a Custom China Fulfillment Solution with FREE Storage for 30 Days

Want to know about our services, fees or receive a custom quote?

Want to know about our services, fees or receive a custom quote?

Please fill out the form on the right and we will get back to you within a business day.

Please fill out the form on the right and we will get back to you within a business day.

The more information you provide, the better our initial response

will be.

The more information you provide, the better our initial response

will be.

TAGS:

TAGS: