Recent developments in U.S.-China economic and trade relations have taken a positive turn, creating significant opportunities for the cross-border e-commerce industry. On October 30, 2025, following negotiations in Kuala Lumpur, both sides reached a joint arrangement covering areas including tariffs and export controls. Key measures from both sides will be suspended for one year.

This change provides cross-border sellers with a more predictable trade environment just in time for the peak sales season.

This article, a comprehensive analysis by SFC, aims to provide cross-border e-commerce sellers with the latest updates on U.S. tariff changes and practical response strategies.

1. Overview of the New U.S.-China Tariff Policies

A spokesperson for the Ministry of Commerce stated on October 30 that U.S.-China trade teams achieved several consensus outcomes through the Kuala Lumpur negotiations.

Major adjustments from the U.S. side

Removal of the additional 10% tariffs imposed on certain Chinese goods, previously referred to as the "Fentanyl tariffs."

Extension of the suspension on the additional 24% retaliatory tariffs on Chinese imports for one year.

Corresponding Adjustments from the Chinese Side

In response to the U.S. tariff adjustments mentioned above, China has simultaneously decided to continue suspending its additional tariffs on certain U.S. goods.

Tariffs

The U.S. will remove the 10% "Fentanyl-related tariffs" imposed on goods from China (including Hong Kong and Macao).

The additional 24% tariffs on goods from China (including Hong Kong and Macao) will remain suspended for one year.

China will make corresponding adjustments to its countermeasures and extend certain tariff exclusion policies.

Export Controls

The U.S. will suspend the "50% Penetration Rule" announced on September 29 for one year.

China will suspend the relevant export controls announced on October 9 for one year and will refine their implementation guidelines.

Section 301 Investigations & Countermeasures

The U.S. will suspend its Section 301 investigation into China's maritime, logistics, and shipbuilding sectors for one year.

China will simultaneously suspend its related countermeasures.

These adjustments are set to take effect from November 10, 2025, significantly reducing Sino-U.S. trade barriers and fostering a more favorable logistics environment for cross-border e-commerce.

2. Latest U.S. Tariff Rates on Chinese Imports

On November 1 and 4 (Local Time), the White House officially announced a series of adjustments to U.S. trade policy towards China, covering areas including tariffs and export controls.

Effective for goods entering for consumption from 12:01 a.m. on November 10, 2025, the United States will reduce the so-called "Fentanyl-related" additional tariffs from 20% down to 10%. Concurrently, it will suspend the 24% retaliatory tariffs, the export control 'Penetration Rule,' and the Section 301 port fees for one year, while extending certain Section 301 tariff exclusions until November 10, 2026.

Understanding the current U.S. tariff landscape for Chinese goods is crucial for cross-border sellers. The table below summarizes the main components of U.S. tariffs on Chinese products, current as of November 12, 2025.

| Tariff Category |

Current Rate |

Status & Validity |

Scope / Key Details |

| Retaliatory Tariffs |

10% |

Increase suspended until Nov 10, 2026; rate remains at 10% during this period |

Additional tariffs levied on top of all existing baseline duties |

| "Fentanyl-Related" Additional Tariffs |

10% |

Reduced from 20% to 10%, effective Nov 10, 2025 |

Applies to all goods originating from China (including Hong Kong) |

| Section 301 Tariffs |

7.5% or 25% (higher for some items) |

Long-term effect, but some products enjoy exclusions |

Target specific sectors of Chinese goods; applicable rate must be verified by specific HTSUS code |

| Section 301 Excluded Products |

0% (Exempt from Section 301 tariffs) |

Exclusions for 178 product categories extended until Nov 10, 2026 |

Exemptions apply only to Section 301 tariffs; Retaliatory and "Fentanyl-Related" tariffs may still apply |

Example of Composite Tariff Rate (Base Rate + Additional Duties): The actual duty rate must be calculated based on the product's HS code, rules of origin, and applicable exclusion lists.

| Product Category |

Base Duty (HS Code) |

Section 301 Tariff |

Fentanyl Tariff |

Section 232 Levy |

Retaliatory Tariff |

Total Tariff |

| General Products |

As per HS Code |

7.5%-25% |

10% |

0% |

10% |

27.5%-45% + Base Duty |

| Steel/Aluminum/Copper Products |

As per HS Code |

7.5%-25% |

10% |

50% |

0% |

67.5%-85% + Base Duty |

| Upholstered Seats / Cabinet & Vanity |

0% |

7.5%-25% |

10% |

25% |

0% |

27.5%-45% + Base Duty |

| Small Kitchen Appliances (Kettles/Coffee Makers, etc.) |

As per HS Code |

0-25% |

10% |

Varies by Material |

10% |

27.5%-45% + Base Duty |

| Textile Bedding Sets |

As per HS Code |

7.5%-25% |

10% |

0% |

10% |

27.5%-45% + Base Duty |

| Auto Parts |

As per HS Code |

25% |

10% |

25% |

0% |

60% + Base Duty |

In summary, the general tariff calculation for Chinese products exported to the U.S. is typically: Additional Duties + Base Duty Rate

Note: 'Additional Duties' specifically refers to (Retaliatory Tariff 10% + Fentanyl Tariff 10%).

Example 1: General Product (Base Duty 3%)

Total Tariff Payable: Base Duty 3% + Fentanyl Tariff 10% + Retaliatory Tariff 10% = 23%

Example 2: Product Subject to Section 301 Tariffs

If not on the exclusion list and subject to a 25% Section 301 tariff:

Total Tariff Payable: Base Duty 3% + Fentanyl Tariff 10% + Retaliatory Tariff 10% + Section 301 Tariff 25% = 48%

3. Strategic Response Guide for Cross-Border E-Commerce Sellers

Verify Your Product-Specific Tariff Rates

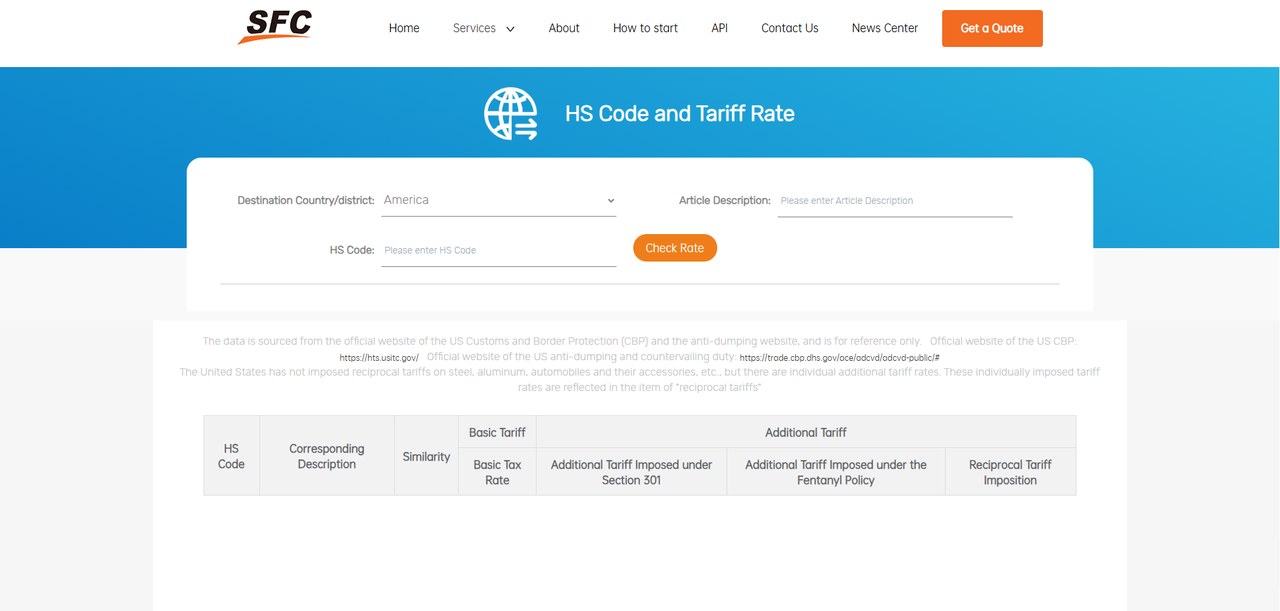

While the U.S. tariff structure is multi-layered, cross-border sellers can utilize the U.S. Customs' HTS lookup tool to pinpoint the exact rates applicable to their products. SFC features a

tariff inquiry page, allowing you to search by product description for initial guidance or by precise HS code for accurate results.

Capitalize on Beneficial Agricultural Products

China has suspended the additional tariffs on key U.S. agricultural imports such as chicken, wheat, corn, and cotton. Cross-border e-commerce businesses in these sectors can leverage this opportunity to benefit from reduced supply chain costs.

Optimize Product Declaration

Ensure accurate declaration by providing the correct product name and the full 10-digit U.S. HTS Code. This guarantees customs calculates duties correctly and prevents delays caused by declaration errors, maintaining smooth clearance efficiency.

Seize the One-Year Window of Opportunity

The one-year suspension of escalated U.S.-China tariffs provides sellers with predictable costs and clearer profit margins, creating a stable foundation for the crucial Q4 peak season. We recommend cross-border sellers fully utilize this period of relative trade stability to proactively plan their supply chain and marketing strategies ahead of the November 2026 deadline.

Partner with a Compliant Logistics Provider

Choose a logistics partner with proven expertise in U.S.-China tariff regulations. Their professional customs clearance experience and compliance management are crucial for ensuring your shipments reach customers without disruption.

Why Partner with SFC Express?

As the cross-border logistics arm of SFC HOLDINGS Co., Ltd. (ChiNext stock code 301558),

SFC offers a diverse range of air and sea freight solutions for the U.S. market. Our services, including discounted small packets and volumetric weight waivers for large items (up to 18,000 cm³), cater to various product types and delivery timelines. We help you select the most efficient and cost-effective shipping channel based on your product value, weight, and specific seasonal logistics needs.

4. Conclusion

This concludes SFC 's analysis of the latest U.S. tariff policies towards China and our corresponding cross-border logistics solutions. For tailored advice on tariff and logistics strategies for your specific products, please feel free to contact your dedicated SFC account manager or reach out to us via our official WeChat channel.

This recent "easing" of U.S.-China tariffs has created the most favorable profit window for cross-border e-commerce sellers in the past year. By partnering with a professional and compliant logistics provider like SFC and making thorough preparations in cost management, logistics, and operations, we are confident that e-commerce sellers are well-positioned to achieve a remarkable turnaround in the upcoming Q4 peak season and unlock significant business growth.

Moving forward, SFC remains committed to monitoring the evolving U.S.-China trade landscape. We will continue to provide you with the latest policy insights and professional logistics services to support your success.

Post Views:2661

Post Views:2661

Want to know about our services, fees or receive a custom quote?

Want to know about our services, fees or receive a custom quote? Please fill out the form on the right and we will get back to you within a business day.

Please fill out the form on the right and we will get back to you within a business day.

The more information you provide, the better our initial response

will be.

The more information you provide, the better our initial response

will be.

TAGS:

TAGS: